Mutual funds in the Caribbean are governed by country-specific legislation and regulations that reflect the objectives and concerns of the host country. They are required to fulfil all of the obligations related to licensing, reporting, audit, and operation that are prescribed in the legislation, and are generally regulated by some regulatory body established to oversee the securities industry within the country.

Mutual Fund Structure

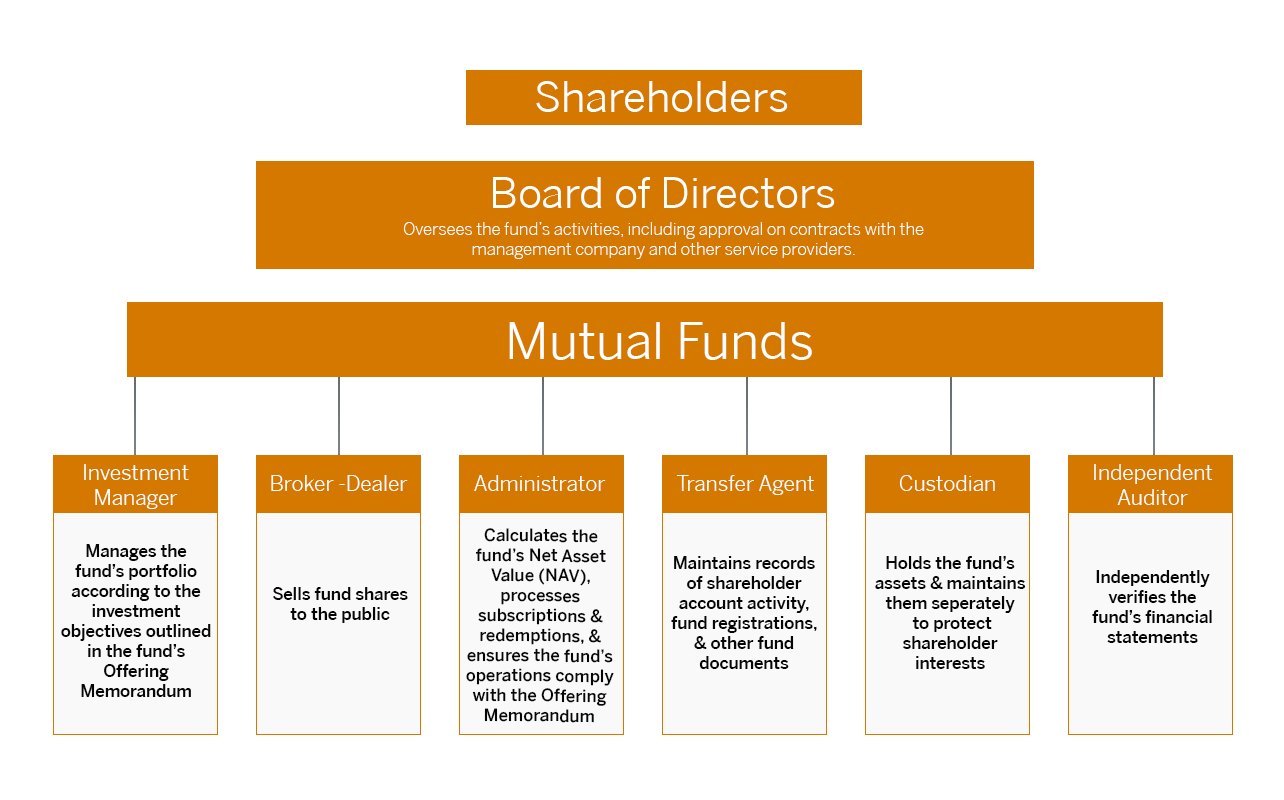

Most funds in the Bahamas are structured as investment companies, complete with a Board of Directors, an Investment Manager, a Custodian, an Administrator, and an Auditor, all of whom perform important and specific roles for the fund. The company itself is governed by the parameters established in its Memorandum and Articles of Association.

Oversight of the ongoing operations of a mutual fund is accomplished through the appointment of a Board of Directors. The board usually consists of reputable individuals who are either associated with the sponsoring company or who provide sufficient expertise in a particular area to assist with the ongoing evaluation and supervision of a fund’s operations.

As with other non-mutual-fund companies, the Board of Directors meets on a regular basis to review the fund’s operations and financials, and to address any related issues. The Board is ultimately responsible for all the activities of the fund.